The International Energy Agency (IEA) has released its latest report on the demand for key minerals from the clean energy transition, which suggests that growing demand for solar photovoltaic (PV) will drive huge global demand for copper.

The report, titled Key Minerals Market Review 2023, describes how achieving global clean energy goals will lead to significant changes in demand for some key minerals such as copper, lithium and nickel.

Changes in global copper demand are particularly important for the solar industry. Copper is a key component of solar modules. The copper backsheets used in many modules are highly conductive, allowing the modules to run for long periods of time, and this is reflected in the use of copper in existing solar equipment.

Citing data from the International Energy Agency, the Copper Alliance, a global trade body representing the copper industry, says that copper usage per MW of PV modules is 2,500kg, and that as installed PV capacity grows globally, so will the demand for copper.

IEA France

Impact of net-zero targets

In a press release announcing the report, IEA Executive Director Fatih Birol said, “Two years ago, we undertook a landmark study of key minerals with an eye to the future and the demand and supply of key minerals.” In that report over two years ago, we saw a mismatch between supply and demand for key minerals. In the report released today, we look at whether that mismatch is still as bad as we found it to be two years ago.

“The market’s response of increasing investment is an important sign that the market is catching on, suggesting that the clean energy transition will be even more rapid in the coming years.”

The IEA uses a variety of scenarios for its projections, including the Announced Promises Scenario (APS), which forecasts demand for minerals based on the announced policies of the world’s governments and projects that private investors plan to build.

Another scenario is the Key Net Zero Scenario (KNZS), which is based on the policies required to achieve net zero emissions by 2050, as set out in the Paris Agreement.

The net-zero scenario is the most ambitious of the various scenarios presented and would require the largest changes to the current energy mix, driving significant changes in demand for minerals. According to the report, annual demand for copper would see the largest increase among commodities over the next few years, rising from just under 5 million tons in 2022 to just over 12 million tons in 2030, and would be just over 15 million tons in the net-zero scenario.

In the net-zero scenario, global copper demand is driven by the solar sector (orange), the wind sector (purple) and “other low-emission power”.

Solar drives copper demand

We are closer to the beginning of the journey than the end,” said Tim Gould, IEA chief energy economist, at the launch of the report. Overall demand for key minerals will grow by a factor of 3.5 by 2030. Clean energy is already a major source of demand growth, with the energy sector accounting for about 90% of lithium demand, nickel and cobalt nearly 60% and copper 45% by 2030.

The data in the report also demonstrates the extent to which each form of renewable energy will contribute to this change in demand. Specifically for copper, in the net-zero scenario, the “power grid” will drive the biggest change in copper demand through 2050, accounting for more than 20% of new copper demand. From cabling to switches to monitoring systems, this is not surprising given copper’s use in power infrastructure.

Contribution of the solar industry to demand for various minerals in the 2050 net-zero emissions scenario, including silicon (yellow), copper (orange) and silver

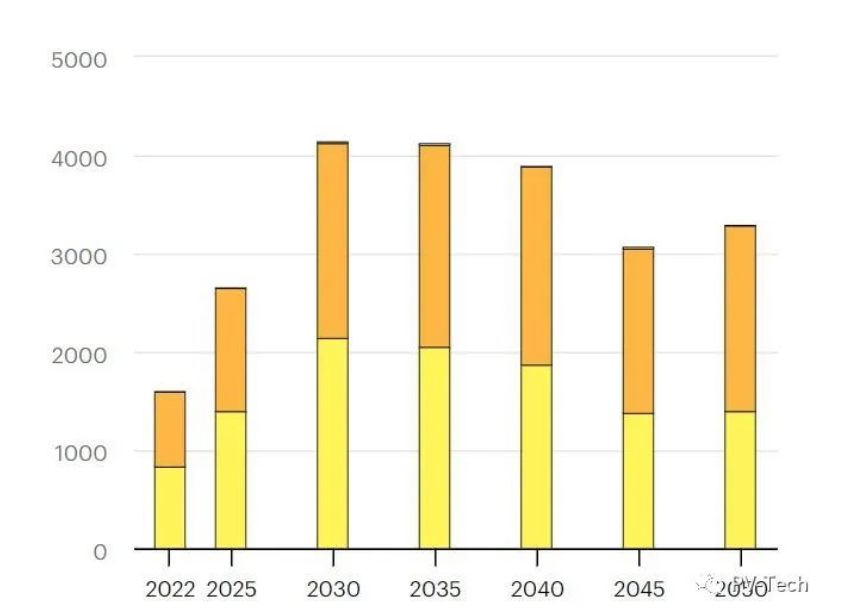

However, the report also links solar photovoltaic (PV) power generation to an increase in copper demand. Global annual copper demand from the solar PV industry would increase from 756.8 kilotons in 2022 to a peak of 2,062.5 kilotons in 2035 and decline to 1,879.8 kilotons in 2050, according to the data.

If the announced copper projects around the world come on line as expected, global copper supply in 2030 will be close to 30 million tons, Gould noted. This is particularly good news for the solar industry, given the necessity of copper for the global solar industry, an industry whose mineral needs will be met over the next decade, rather than relying on commodities such as lithium, nickel and cobalt, as other industries do. Currently, supply plans for these commodities are not expected to meet demand.

Long-term uncertainty

However, there are concerns about the long-term supply of copper, which may pose a challenge to the long-term development of solar energy.

Tae-Yoon Kim, lead author of the IEA report, said: “For copper, we see strong demand growth over the next decade as we work towards clean energy goals, with copper being used in a wide range of clean energy projects including energy networks and renewables. A look at the projects under construction in the medium term shows that we are not seeing high quality, large-scale projects, which means that there could be some pressure in the medium or long term in order to meet copper demand over the next few years.”

More broadly, the average installed price of a wide range of renewable power generation technologies has risen in recent years, ending years of a sustained downward trend, which could make it more challenging to build new clean power facilities.

The average price to install a wind turbine has increased from about $750,000 per megawatt in 2019 to about $800,000 per megawatt in 2022, and the price to build a solar module has increased from about $200,000 per megawatt in 2022 to nearly $250,000 per megawatt in 2022. While solar installation prices are still well below what they were a decade ago (they were as high as $700,000 per megawatt in 2014), recent shifts in demand for minerals have had a ripple effect on the prices of the technologies that rely on them.

“Behind the slight increase in costs is an increase in the price of some key mineral inputs,” Gould said, warning that higher installation prices are either an ongoing challenge for the sector. “While key mineral prices have eased this year, it won’t take much to see these cost pressures make a comeback.”