Recently, news of widespread power outages in Vietnam has stormed onto the news. Even big manufacturing companies such as Samsung and Foxconn have had to face the problem of power outages and production shutdowns.

Partial power outage in Hanoi

“Many factories have had to shut down production due to severe power outages, and they are frequent.” Hong Sun, president of the Korean Chamber of Commerce in Vietnam, said, “This is a very serious problem for Korean companies operating in Vietnam.”

The problem of power outages in Vietnam is not a recent one; on May 21, the Vietnamese media reported that the Electricity Group of Vietnam had issued a circular that most parts of the country, including the capital Hanoi, would implement a policy of rotating power outages. The Vietnamese authorities at the time thought that the blackout problem might continue until the end of May, but in hindsight, they were still too optimistic.

According to Prime Minister Pham Minh Triet, the main reasons for the blackouts were a sharp increase in electricity consumption due to the heatwave, and a significant reduction in power output due to a drop in water levels at hydropower stations as a result of the drought.

In early May, Vietnam recorded its highest temperature ever – 44.1 degrees Celsius – breaking a record set in 2019.

Residents pour water on their roofs to cool down

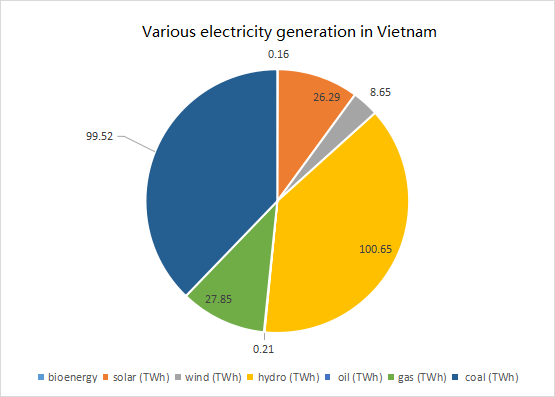

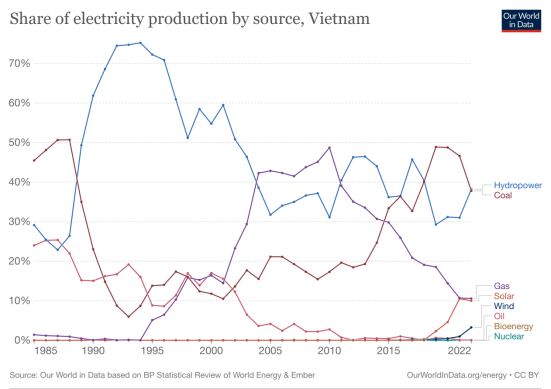

As of today, Vietnam’s total installed power capacity is around 70GW, with around 20GW of hydropower and 16GW of PV soaring from 105MW in 2018 to 2020. there is also around 20GW of coal power installed.

In terms of power generation, hydropower and coal power are in the absolute majority. According to recent figures from the Vietnam Electricity Group, as of June 11, the power output for the last 2 weeks has been less than half of the peak and has not even been able to meet the daily power load, not to mention the recent heat wave that is hitting the country.

According to the Electricity Group of Vietnam, demand for electricity has increased approximately fourfold since 2006, reaching 42.5 GW by 2021.

And the densely populated, industrially developed northern region of Vietnam still has less than 5GW of installed capacity.

Coal-fired power plants accounted for around 60 per cent of electricity output last week, according to Electricity Group of Vietnam data, and Vietnam’s coal imports stood at 4.5 million tonnes in May, the highest level since June 2020, according to Refinitiv.

However, some northern Vietnamese hydropower plants generated only a fifth of last year’s output due to reduced precipitation. Almost all northern hydropower plants are suffering from a shortage of water to reach a quarter of their designed power output, the Vietnamese Ministry of Industry said.

And while installed PV capacity is currently around 20GW, according to the Vietnam Electricity Group, PV’s peak generation output during the heatwave was also only around 10.5GW.

In March 2020, the Politburo of Vietnam had issued Resolution 55 on the energy strategy to 2030, highlighting that the installed capacity is expected to reach 125-130GW by 2030.

During cop26 in 2021, Vietnam pledged to achieve net zero emissions by 2050. Vietnam then proposed Power Development Plan 8 (or PDP8).

However, PDP8 was controversial in Vietnam and was only officially approved on 15 May this year.

PDP8 assumes that commercial electricity consumption in Vietnam is expected to reach approximately 335 billion kWh by 2025 and approximately 505.2 billion kWh by 2030. By 2050, this figure is expected to increase to between 1,224 billion kWh and 1,378 billion kWh.

To meet the growth in electricity demand, electricity generation is growing as follows:

01 Wind power

In 2030, onshore wind power reaches 21.88 GW and offshore wind power reaches 6 GW; offshore wind power reaches 70 to 91.5 GW in 2050.

02 Photovoltaic

4.1GW of new installations by 2030 and 2.6GW of additional rooftop PV.

03 Biomass power generation

Total installed capacity will reach 2.227GW by 2030 and more than 6GW by 2050.

04 Hydropower

More than 29GW installed in 2030, reaching more than 36GW in 2050.

05 Energy Storage

Develop 2.4GW of pumped storage and 300MW of electrochemical energy storage in 2030.

06 Coal power

30GW of installed capacity in 2030, phasing out in 2050.

07 Gas power

37.6GW of total installed capacity in 2030, transition to hydrogen generation in 2050, and only 11GW of conventional gas power.

According to PDP8, Vietnam will have 150GW of installed capacity by 2030, while the new plan calls for a significant increase in Vietnam’s already large renewable energy capacity, as well as the development of gas-fired power generation, particularly the import of liquefied natural gas (LNG), to replace most of the current coal-fired capacity.

Changes in the structure of Vietnam’s power generation capacity

In the face of such massive installed capacity growth, lack of money is a problem that Vietnam has to face.

Vietnam’s power sector is expected to require approximately US$134.7 billion in investment between 2021 and 2030, of which US$119.8 billion will be spent on new installed generation capacity and US$14.9 billion on grid infrastructure. From 2031 to 2050, Vietnam’s power sector will need US$399.2 billion to US$523.1 billion in investment. According to the World Bank, Vietnam will need US$368 billion in investment by 2040 to put the country on a path to net zero emissions.

In 2022, the G7 had expressed its willingness to provide $15.5 billion to Vietnam to help the country transition away from coal.

Diplomats and officials involved in talks with Hanoi said little progress had been made in releasing funds as the government struggled to decide which sector should be entrusted with the project, Reuters reported.

The decision-making body envisaged for April has yet to materialise and foreign officials are concerned that the first draft of a plan for the use of the funds will not be ready in November as planned.