Source: China Chamber of Commerce for Import and Export of Machinery and Electronic Products Date: June 5, 2023

Ⅰ.Overview of the Low Voltage Electrical Appliance Industry

Against the backdrop of “peak carbon emissions,” “carbon neutrality,” and the 14th Five-Year Plan’s emphasis on deepening the supply-side structural reform and developing low-carbon electricity in the power industry, China’s low voltage electrical appliance industry has encountered new development opportunities. In recent years, despite challenges such as fluctuating raw material prices and a complex global trade environment, the low voltage electrical appliance industry in China has actively sought new breakthroughs, embraced digitalization, and maintained steady and robust growth. In 2022, the total export value of the low voltage electrical appliance industry reached a historical high of $23.09 billion, representing a year-on-year increase of 1.7%. Industry enterprises have closely followed market demands and development trends, continuously improved traditional low voltage electrical appliances, enhanced product performance in terms of green, digital, intelligent, and communicative aspects, and promoted the expansion of low voltage electrical appliances into the smart grid industry.

Ⅱ.Q1 2023 Import-Export Situation of Low Voltage Electrical Appliance Products in China

(1) Exports in Q1 declined by 3.3% YoY, while imports dropped by 25%.

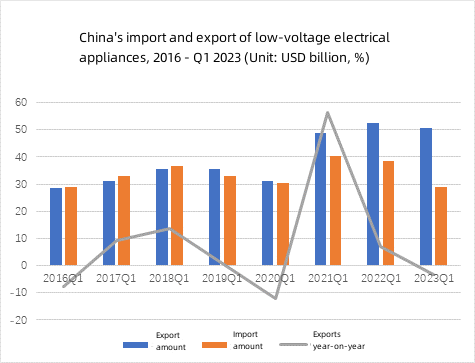

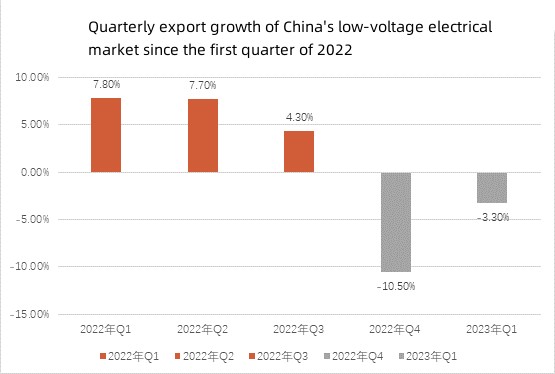

According to statistics from the General Administration of Customs, in Q1 2023, the export value of China’s low voltage electrical appliance products reached $5.05 billion, representing a 3.3% YoY decline. Compared to the 7.8% YoY growth in Q1 2022, this indicates a significant decrease.

During the same period, the import value of low voltage electrical appliance products in China was $2.89 billion, showing a 25.3% YoY decline. Compared to a 4.3% YoY decline in Q1 2022, this decline further expanded by 21%.

Since Q4 2022, the export growth rate of China’s low voltage electrical appliances has been declining, primarily due to the complex international economic situation, the transition of the pandemic towards a normal social state, and a significant reduction in overseas market demand.

(2)The overall performance of China’s major import and export markets for low-voltage electrical products in the first quarter was poor

1. The main export market demand for low-voltage electrical appliances in the first quarter was not strong

In the first quarter of this year, the United States, Hong Kong, Vietnam, Japan and Germany were the top five export destinations for my low-voltage electrical products. Among them, exports to the U.S. amounted to 690 million U.S. dollars, up 1.0% year-on-year, accounting for 13.6% and ranking first; exports to Hong Kong, China amounted to 660 million U.S. dollars, down 28.1% year-on-year, accounting for 13.1% and ranking second; exports to Vietnam amounted to 340 million U.S. dollars, down 12.7% year-on-year, accounting for 5.9% and ranking third.

In the first quarter, my total exports of low-voltage electrical appliances to other RCEP member countries amounted to 1.34 billion U.S. dollars, of which, the combined exports to the top three export destinations (Vietnam, Japan, Singapore) accounted for more than half of the total exports, amounting to 55.5%.

Exports to Singapore had the fastest year-on-year growth rate of 40.46%. Switch (line V ≤ 1000V) this single product exports to Singapore, the fastest year-on-year growth rate of 382.5%.

2. China’s imports of low-voltage electrical appliances from major import sources all fell in the first quarter

In the first quarter, China’s imports from the top ten sources of low-voltage electrical appliances were all down year-on-year. Among them, the main import sources are still Japan, Germany, South Korea and the United States, which account for 46.2% of the total imports of low-voltage electrical appliances. Among them, the import from Japan is 640 million U.S. dollars, down 34.8% year-on-year, ranking first; import from Germany is 330 million U.S. dollars, down 1.9% year-on-year, ranking second; import from Korea is 210 million U.S. dollars, down 30.2% year-on-year, ranking third; import from the United States is 150 million U.S. dollars, down 6.9% year-on-year, ranking fourth.

(3) The first quarter of my 13 types of key low-voltage electrical exports fell slightly to 3.3%

In the first quarter, China’s low-voltage electrical product segments, the working voltage does not exceed 36 volts of the plug-in exports of 1.19 billion U.S. dollars, still ranked first in my low-voltage electrical exports, but a significant decline of 18.5%. The top five export destinations for this product were Hong Kong, China ($350 million), Vietnam ($170 million), the United States ($100 million), Taiwan, China ($80 million), Japan ($70 million), with exports of -33.1%, -23.7%, -15.3%, -21.9%, and 2.2% year-on-year, respectively. Among the top ten export markets in my 13 key low-voltage electrical segments, exports to India increased the most year-on-year by 16.1%.

III. Problems of China’s low-voltage electrical appliances export at this stage

(a) Low-voltage electrical appliances manufacturers need to make great efforts in key core technologies

In recent years, although China’s low-voltage electrical appliances have achieved rapid development, there is still a large gap between them and the global advanced production technology. Currently, under the construction of new distribution systems, a series of interdisciplinary production technologies are playing an increasingly important role in the process of industry transformation and upgrading, but most of the core technologies are not mastered by low-voltage electrical enterprises, and technical barriers are still restricting the development of the industry and need to be tackled.

(2) Guiding the differentiated development of low-voltage electrical enterprises in the whole industry and promoting new changes

At present, there are shackles in my low-voltage electrical industry in the following aspects: on the one hand, most enterprises lack a perfect R&D system and platform, and their independent innovation and development capabilities are insufficient; on the other hand, many small and medium-sized manufacturing enterprises compete for the market with low-priced products, which disrupts the normal competition order and is not conducive to the green upgrading and deep transformation of the whole industry.

IV. Suggestions for the development of China’s low-voltage electrical industry

(I) Build a new and more advanced electricity distribution system

The low-voltage electrical industry needs to overcome and apply a series of core supporting technologies such as new generation power electronics technology, Internet of Things technology, as well as key application technologies such as distribution network planning and evaluation, and comprehensive energy control, and at the same time integrate various new applications and new models, so as to build a more systematic new distribution system.

(2) Promote industry-wide technical reform

It is recommended to promote industry-wide technological reform and guide the differentiated development of different types of enterprises in the industry; encourage leading enterprises to increase R&D and innovation, support small and medium-sized enterprises to carry out model innovation, and expand the scale of enterprises by joining the green and intelligent reform track. Implement intelligent upgrading of factories, accelerate the digital, intelligent and green transformation of manufacturing industries, and explore the development of new models of service-oriented manufacturing.

V. Outlook for the development of low-voltage electrical industry in 2023

On April 21, 2023, the National Standards Committee and other 11 departments released the “Guide to the Construction of the Carbon Peak Carbon Neutral Standard System”, which states that by 2025, no less than 1,000 national and industry standards (including foreign language versions) will be made and revised, following the degree of consistency of international standards, the main industry carbon accounting verification will achieve full coverage of the standard, and the energy efficiency standard indicators of key industries and products will be steadily improved In this context, I have been working on the development of low-voltage electrical appliances. Against this background, our low-voltage electrical appliances should follow the development trend of green and clean energy, actively carry out technology research and development and upgrade, and manufacturing enterprises should make more efforts to develop green and innovative products, so that they can show greater potential in the new power distribution system and drive the efficient development of the industry in all aspects.

In the first quarter, although China’s low-voltage electrical exports fell slightly, but in 2023 the opening of a favorable macro, the market is expected to improve the background, it is expected that my low-voltage electrical appliances in the third quarter to reverse the current decline, the annual export volume will be stable at about 24 billion U.S. dollars scale. (Executed by: Hu Huijia, Machinery Industry Department)